Investing wisely is a cornerstone of financial success, and the journey begins with selecting the right investment app. In this extensive guide, we delve into the best investment apps, each tailored to meet the diverse needs of investors. Whether you’re a beginner or an experienced trader, these apps offer a user-friendly interface, robust tools, and real-time market data to help you with your investing journey.

Let’s explore the best investment apps with lowest fees for 2024

Best Investing Apps for Beginners

1. XTB — Mastering High Leverage for Stocks and ETFs

In the realm of high-leverage trading, XTB emerges as a European-based platform offering a comprehensive suite of trading options, from forex to cryptocurrencies. With a competitive spread and a unique 10:1 leverage on stocks and ETFs, XTB caters to experienced traders seeking valuable tools. The app’s accessibility is currently limited to Android devices, but its advanced charts, multiple indicators, and various assets make it a powerhouse for strategic trading.

Pros

- Multiple assets with $0 commission on stocks and ETFs.

- No minimum deposit required.

- Access to advanced trading charts.

Cons

- Does not accept US clients.

- Assets are CFDs, and clients don’t own the actual asset.

Available Assets

Forex, Stocks (CFD), ETFs (CFD), Indices (CFD), Cryptocurrencies (CFD), Commodities (CFD)

2. Interactive Brokers (IBKR) — Accessing Global Markets with Diverse Assets

For those seeking global market access, Interactive Brokers stands tall, offering entry to 150 markets worldwide. Stocks, ETFs, mutual funds, options, futures, cryptocurrencies, and bonds—all under one roof. Its mobile app provides access to advanced charts and tools, making it an attractive choice for both beginners and seasoned traders. The Options Wizard simplifies trading strategies, adding versatility to the trading experience.

Pros

- Global access to stocks and funds.

- No inactivity fees.

- Fractional shares available.

Cons

- Platforms may seem complex initially.

- Complex pricing structure for certain assets.

Available Assets

Stocks, ETFs, Mutual funds, Hedge funds, Currencies, Cryptocurrencies, Options, Futures, Bonds

3. Robinhood — Streamlined Trading for Stocks, Options, and Cryptocurrencies

Robinhood, synonymous with simplicity, became a household name during the Covid pandemic. Its app, with $0 fees on stocks, ETFs, and crypto trading, caters to over 10 million active users. The introduction of fractional shares and pioneering no-commission trading propelled Robinhood into the spotlight. Options trading, once complex, is now simplified, making it one of the best investment apps for stock enthusiasts.

While investing in stock market its essential to have knowledge of the best investment strategies

Pros

- Fractional shares and $0 commission.

- Beginner-friendly app.

- Access to IPOs.

Cons

- No mutual funds or bonds.

- Limited to US customers.

Available Assets

Stocks, ETFs, Cryptocurrencies, Options

4. Acorns — Automated Investing with a Round-Up Feature

Acorns brings a unique round-up feature to the table, automatically investing spare change from daily purchases. For hands-off investors, this app offers pre-built portfolios with popular ETFs and even allows a percentage allocation to Bitcoin. While the fee starts at $3 per month, the simplicity of automated rebalancing and investing makes it an attractive choice for maximizing savings effortlessly.

Pros

- Round-up feature for automatic investing.

- Automatic rebalancing.

- Hands-off investment approach.

Cons

- Monthly fee starting from $3.

- Available only in the US.

Available Assets

ETFs via robo-advisor

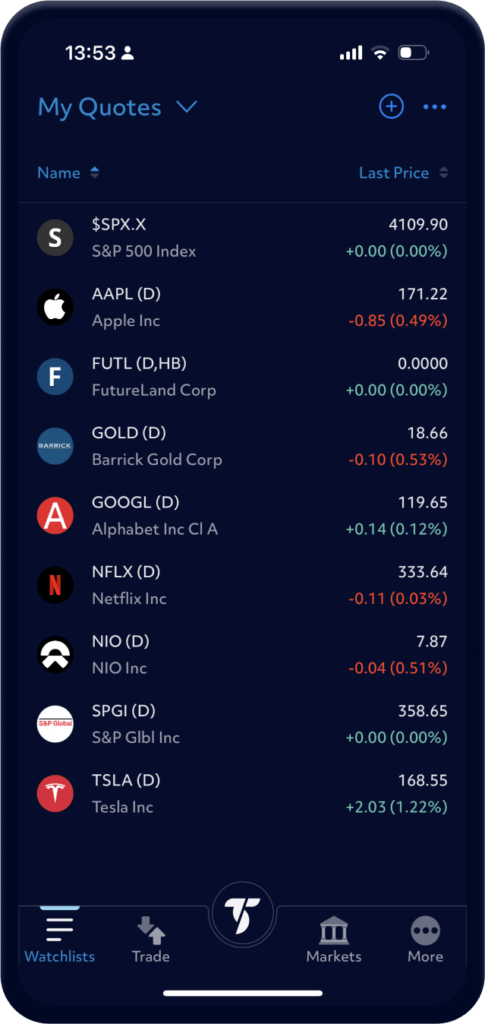

5. TradeStation — Empowering Active Traders with Advanced Tools

True to its name, TradeStation empowers active traders with an advanced platform, offering a diverse range of assets, including stocks, ETFs, options, and cryptocurrencies. The app, designed for both beginners and experienced traders, provides educational resources and courses to enhance trading skills. With the option to automate trading strategies, TradeStation stands out as one of the best apps for those seeking a robust trading experience.

Pros

- Advanced trading platforms and research tools.

- Option to automate trading strategies.

- Diverse range of trading assets.

Cons

- Inactivity fee unless specific conditions are met.

- Limited to the US.

Available Assets

Stocks, ETFs, Mutual funds, Options, Futures, Futures options, Cryptocurrencies

Also read about: Best Ways to Invest in Gold

6. Wealthbase — Gamified Learning for Aspiring Traders

Wealthbase takes a creative approach, offering a gamified learning experience for aspiring traders. This app allows users to learn trading by playing solo or with friends. With customizable game rules and the ability to simulate stocks, ETFs, and crypto trading, Wealthbase makes the learning process engaging and enjoyable.

Pros

- Simple and engaging learning experience.

- Free for up to five players.

- Simulation of stocks, ETFs, and crypto trading.

Cons

- Unable to trade with real money.

- Groups larger than five incur a $20 per game fee.

Available Assets

Stocks, ETFs, Cryptocurrencies

7. Public.com — Exploring Alternative Assets Beyond Stocks

Public.com caters to investors looking to explore alternative assets alongside traditional stocks. Offering fractional shares of art, NFTs, and collectibles, this app adds a unique dimension to investment portfolios. With a user-friendly design, Public.com is accessible to investors of all levels, providing an opportunity to diversify beyond conventional assets.

Pros

- Easy-to-use investment app.

- Access to alternative assets like art and NFTs.

- Offers automated trading portfolios and Treasury bills.

Cons

- Limited to the US and the UK.

- Premium features cost $8 per month.

Available Assets

Stocks, ETFs, Cryptocurrencies, Treasury bills, Fine art, NFTs, Collectibles

Also read about: Best Physical Investments for Higher Returns

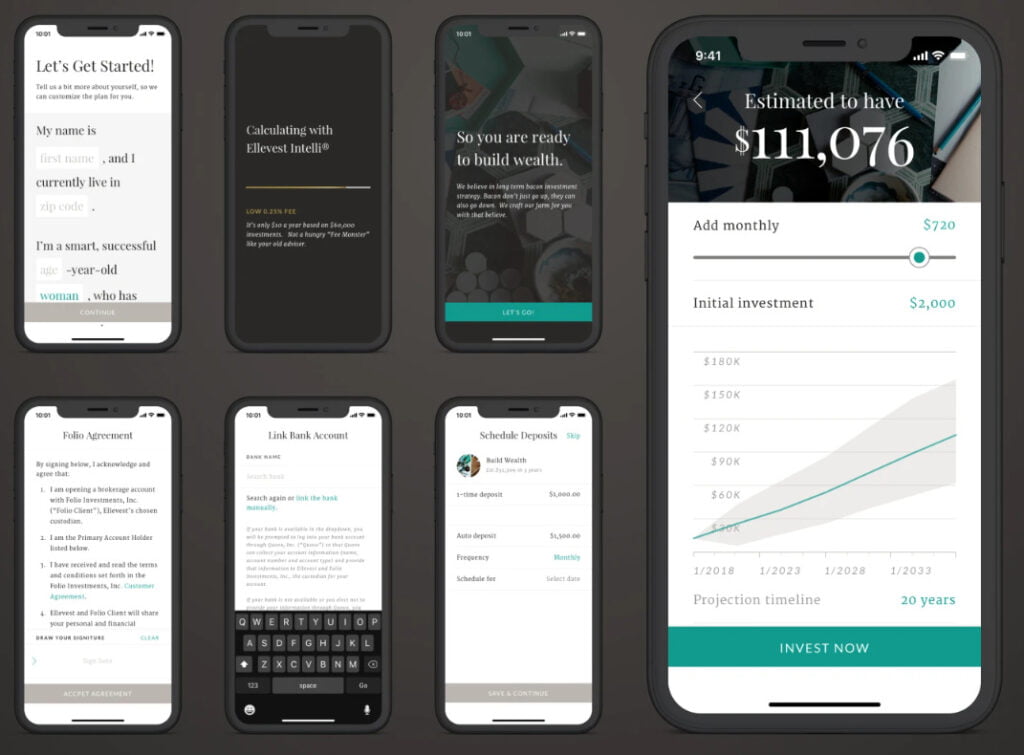

8. Ellevest — Tailored Investing for Women Investors

Ellevest, designed for women investors, operates as a robo-advisor service, offering automated investing and portfolio rebalancing. With a focus on low-cost ETFs and personalized goal-specific portfolios, Ellevest provides education services and access to human advisors. While it comes with a monthly fee, it’s tailored for women who want to learn how to invest or use a robo-advisor to manage their portfolio.

Pros

- Beginner-friendly app for women.

- Automated investing with portfolio rebalance.

- Access to human advisors.

Cons

- Available only in the US.

- Monthly fee starting at $12.

Available Assets

Robo-advisor that invests in stocks and ETFs

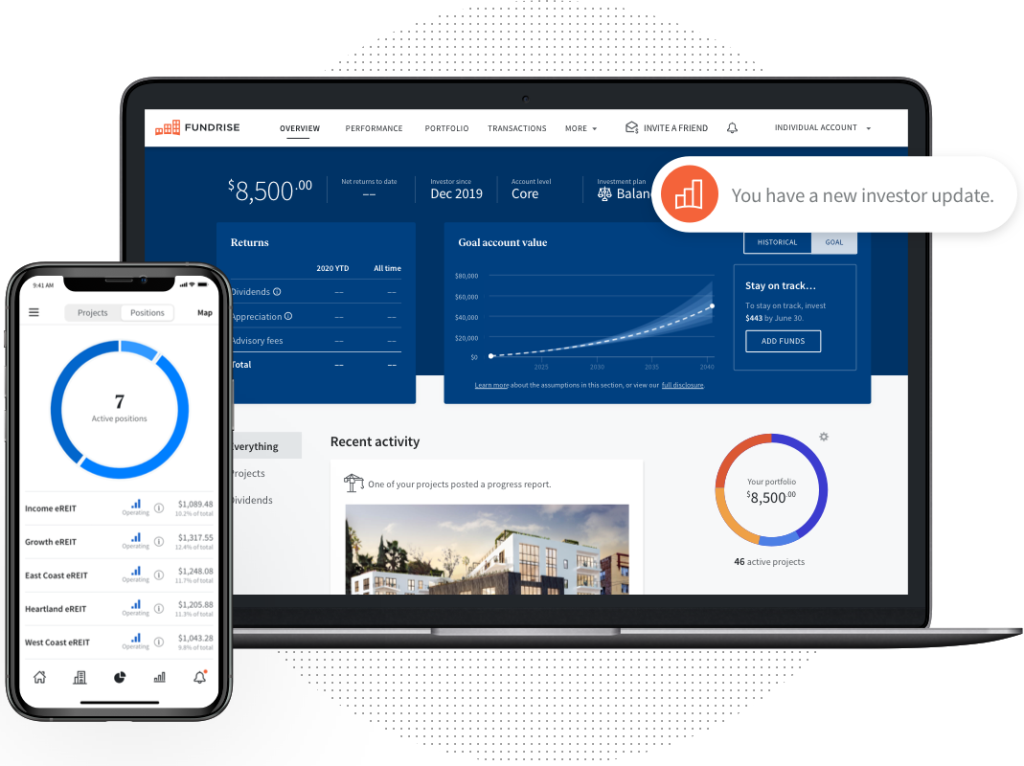

9. Fundrise — Diversifying Your Portfolio in Real Estate and Tech Start-ups

Fundraise presents a unique opportunity to diversify your portfolio by investing in real estate, private credits, and tech start-ups. With a minimum investment of $10, investors can explore various assets, from family homes to innovative tech companies. While the app currently caters exclusively to the US, its intuitive design and diverse investment options make it an intriguing choice for those looking to broaden their investment horizon.

Pros

- Invest in real estate with as little as $10.

- Diversified investment options.

- Access to private credit and tech companies.

Cons

- Limited to the US.

Available Assets

Real estate, Private credit, Tech start-ups

Conclusion

Selecting the best investment app is a pivotal step toward building wealth and securing your financial future. Whether you are drawn to XTB’s high leverage, Robinhood’s streamlined experience, or Wealthbase’s gamified learning, each app brings a unique approach to the table. Consider your financial goals, personal preferences, and the features offered by each app to make an informed decision. Remember, the right investment app can be the catalyst for your financial success.

If you have any specific queries comment down below or contact Finanzerr via email.

Invest wisely, and let your money work for you. Happy investing